Written by: Jim Hughes

After being a police officer with the Dallas Police Department for 32 years, I recently retired and decided to research technology that is being used by police departments and commercial businesses to reduce and deter crime.

As a Director of the North Texas Crime Commission, I attended meetings with the National Insurance Crime Bureau (“NICB”) and chaired a cargo theft committee. I also met with several loss prevention managers and specialists at several commercial insurance providers.

It is apparent that technology and managed services are available today to reduce crime and reduce losses incurred by the insurance industry. In order to maximize the benefit to all parties, the insurance companies, security providers, and businesses must communicate their needs and standards should be set. The insurance industry is slow to change and refuses to develop a strategy to embrace the benefits.

The solution is to build a team relationship with both the customer and service provider. The customer will pay for the technology and services. The security service provider should be focused on implementing a cost-effective solution and remaining a partner to ensure protection is in place for the long term. In order for the insurance companies to reduce their losses, they need to play a role in the process by defining standards and offering an incentive discount to the customer for implementing these standards. Clearly, the managed service security provider must have high standards and manage expectations of all concerned parties. It is understood that the solution will never stop all crimes but steps can be taken to mitigate the losses. Experiences, success stories, testimonials and demos can be shared to understand the capabilities and limitations of the system so that all parties are aware of the strengths and weaknesses of the system.

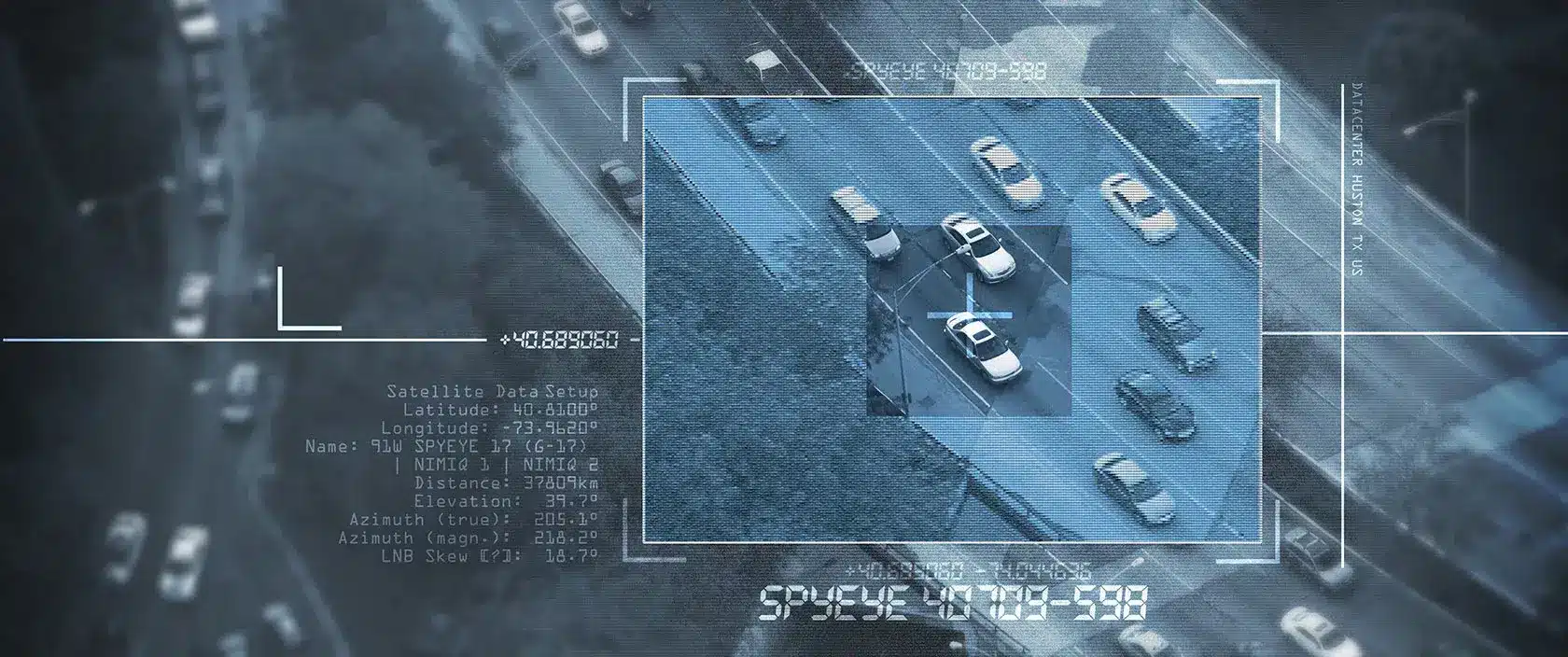

One of the security service providers I met, named Stealth Monitoring inc. (“Stealth”) in Dallas, installs security cameras and access control equipment. They also live video monitor cameras and tracking devices. They proactively monitor cameras with trained operators, some of whom are retired police officers looking for unusual activities. Although the service will never stop all crimes, it does go much further than event based monitoring to mitigate losses and reduce crime. Norm Charney, owner of Stealth, would like to partner with at least one insurance company to establish these standards with value added input from the industry. For example, the standards might be based on:

- Sufficient security cameras in and around the facility to cover all the blind and dark areas where the thief can gain access or vandalize. ( customers often install too few cameras to see all sides of the property.)

- Installing roof top cameras using infra red lighting to protect the HVAC, copper and roof top access to tenants through skylights.

- Live video monitoring to proactively take action by dispatching police before the criminal leaves the property when possible. Sometimes the police can be dispatched before damage is done to the property.

- Redundant power and constant and reliable internet connectivity. Professional thieves can interrupt power sources or disable internet connectivity.

- Additional lighting will often deter criminal activity

- High definition cameras are becoming more cost effective and should replace older analog cameras that are not effective and often have blurry pictures.

Many times the owner of a business will not spend the money to meet these standards. These standards are becoming more and more prevalent with advanced technology available at cheaper prices. For example, if the insurance company were to offer a 10% discount for companies meeting these standards, the insurance industry will see the benefit of fewer losses.

Until one leader in the insurance industry steps forward, the finger pointing will continue and the industry will be ready to blame the security provider when losses are incurred. Incomplete security systems or low standards will always be penetrated by professional criminals and the opportunity to take advantage of newer technology will be wasted.

After developing expertise in the security industry for several years, Stealth gave me a demo of their capabilities and examples of actual video footage captured and managed in real time. They live video monitor thousands of cameras for hundreds of customers across the US and Canada. They have defined their standards to deter and reduce crime at many of their clients across many industries with customized designs and applications. Until all of these standards are addressed and the insurance industry comes to the table, the insurance industry will not reduce their losses or see the benefits.