Key Takeaways:

- Great Freight Recession of 2024: The transportation and logistics sectors were heavily impacted by a freight recession caused by global economic slowdowns, reduced consumer spending, and geopolitical tensions affecting global supply chains.

- Economic Impacts: Reduced freight volumes led to decreased shipments and impacted various transport modes including trucking, rail, and maritime. This recession particularly affected industries like automotive and electronics.

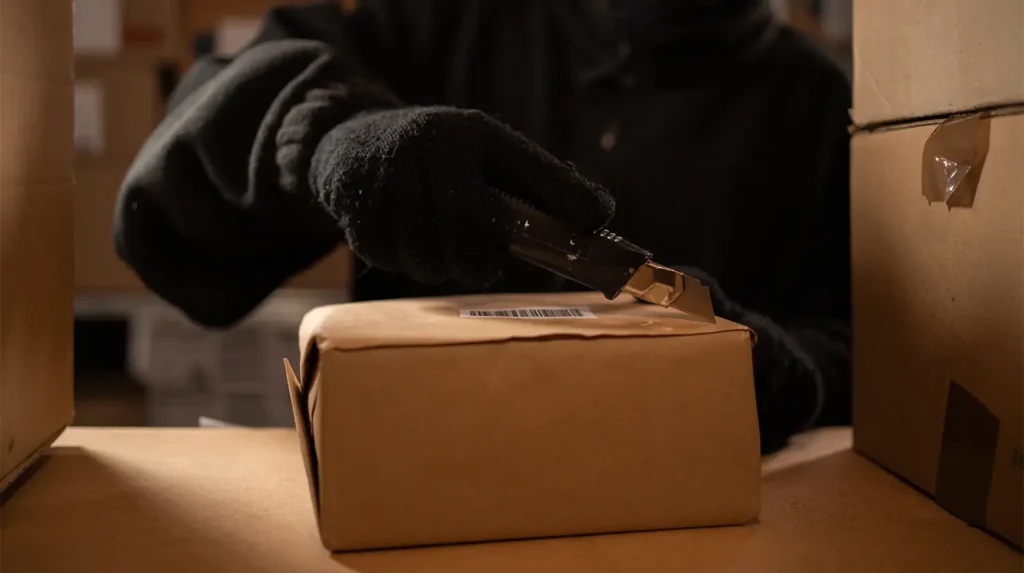

- Cargo Theft Increase: There was a significant rise in cargo theft incidents in 2024, with a record-breaking 3,625 incidents reported in the U.S. and Canada. The increase in thefts was noted particularly in states like California and Texas, and involved sophisticated methods of stealing.

- Employment and Technological Innovations: The recession led to job cuts and a push towards adopting new technologies such as AI and blockchain for better management and security of shipments.

- Proactive Security Measures: Companies are encouraged to adopt comprehensive security solutions, including AI-enabled cameras and live video monitoring, to deter theft and protect their operations.

The Great Freight Recession of 2024

Looking back over the past year, it’s pretty apparent that the transportation and logistics industries faced significant security challenges in 2024. As the Great Freight Recession maintained its hold, the impact on all aspects of the supply chain- alongside surging cargo theft- was profound. This downturn was marked by a decrease in freight volumes, affecting various modes of transport, including trucking, rail, and maritime shipping. This decline in activity can be attributed to several contributing factors, including economic slowdowns in key markets, shifts in consumer demand, and geopolitical tensions that disrupted global supply chains.

Freight Recession Economic Impacts

One of the primary drivers of the ongoing 2024 freight recession was an overall global economic slowdown, which reduced consumer spending and business investment. This slowdown led to decreased demand for goods, directly impacting freight volumes. As businesses anticipated lower sales, they reduced their inventory levels, leading to fewer shipments and a contraction in freight activity. This downturn was especially intense in sectors like automotive and electronics, which are typically heavy users of freight services. While the CEO of freight industry publication FreightWaves declared the Great Freight Recession “dead” as of November, 2024– the general impacts across the supply chain remained a significant pressure for more than 2 years.

As of early January 2025, the United Nations reports that global economic growth is projected to remain at 2.8 percent in 2025– a rate that is unchanged from 2024. This outlook means the repercussions of the global economic slowdowns will likely continue to be felt for the foreseeable future. Despite withstanding the ongoing strain felt due to the global pandemic, economic growth has ultimately stagnated. The report goes on to say that the United States is expected to experience a slowdown in 2025 thanks to consumer spending slowing, and labor markets softening.

“Countries cannot ignore these perils. In our interconnected economy, shocks on one side of the world push up prices on the other. Every country is affected and must be part of the solution,” – UN Secretary-General António Guterres

Industries Impacted by the Freight Recession Respond to the Challenges

The freight transportation downturn has been unprecedented, sending ripples throughout the entire logistics ecosystem. In the trucking industry, the impact has been profound. As cargo volumes dwindled, carriers found themselves competing for a shrinking pool of shipments, leading to a market flooded with excess capacity. This imbalance triggered a domino effect of falling freight rates, squeezing profit margins across the industry. Most major carriers leveraged their substantial reserves to maintain operations. Unfortunately, the impacts on smaller and mid-sized companies were sometimes devasting, with some forced to undergo dramatic restructuring or cease operations completely.

The ripple effects extended to the rail sector, where operators confronted their own set of challenges. Many rail shipping firms made substantial investments in infrastructure and service expansion during more prosperous times, railways now grappled with underutilized assets as industrial shipping volumes contracted. The resulting price competition intensified financial pressures across the rail network, compelling operators to reassess their strategic positioning.

Maritime shipping felt similar headwinds, especially in the container industry, where global trade patterns directly influence demand. Shipping lines responded to declining container throughput with strategic capacity management, implementing “blank sailings” – the practice of canceling scheduled voyages to better align capacity with demand and maintain rate stability. This defensive measure highlighted maritime shipping’s determination to preserve operational viability even in such challenging market conditions.

Employment Impacts and Technological Innovations

Beyond the immediate financial impacts, the freight recession of 2024 had broader implications for employment within the transportation and logistics industries. Job cuts became a common response as companies moved to reduce their workforce alongside reduced operational needs. This not only affected those directly employed in these subindustries but also had a ripple effect on related fields, like vehicle manufacturing and maintenance, logistics software providers, and freight brokers.

In response to these challenges, companies across the transportation and logistics sectors accelerated their adoption of technology and innovation. There was an increased focus on improving operational efficiencies through automation and digital technologies like artificial intelligence (AI) and blockchain for better tracking and management of shipments. Companies also reevaluated their supply chain strategies, with a greater emphasis on diversification and resilience to withstand similar downturns in the future.

The freight recession of 2024 serves as a stark reminder of the vulnerabilities in the transportation and logistics industries and underscores the need for agility and continuous innovation in these sectors. As these industries continue to navigate out of the recession, the lessons learned during this period will likely shape their strategies for years to come, focusing on sustainability, efficiency, and adaptability to ever-changing market conditions.

Cargo Theft Continues Its Rise

Ongoing spikes in cargo theft over the past several years continued to plague businesses throughout the supply chain, sending shockwaves through the logistics industry, with 2024 shaping up to be a year of unprecedented challenges. Setting the tone, in just three months of 2023, nearly 700 thefts were reported – a jaw-dropping 59% jump from the previous year. And the theft trends continued to climb into 2024.

On January 21, CargoNet, a New Jersey-based logistics security firm, unveiled data from its 2024 Supply Chain Risk Trends Analysis. The findings from this report were alarming, highlighting what the company described as “record-breaking” levels of cargo theft across the United States and Canada. Over the course of the year, an unprecedented 3,625 incidents were documented, underscoring a critical and growing challenge within the supply chain sector.

This figure represents a significant 27% surge in theft activity compared to 2023—a year already notable for its record-setting levels of cargo theft. CargoNet reported that each quarter of 2024 consistently broke the previous records established in 2023, highlighting an escalating trend in theft incidents that is capturing industry-wide attention.

The thieves’ favorite hunting grounds? California, which reported a 33% rise in incidents, and Texas, which experienced a dramatic 39% surge. Warehouses and distribution centers bore the brunt of these attacks, with truck stops not far behind.

Crime statistics often read like dry numbers, but the story behind these cargo theft figures is anything but boring. Take Dallas County, Texas – in a dramatic twist, theft incidents skyrocketed by a staggering 78 percent.

Not to be outdone, Los Angeles County continued its notorious reputation as a cargo theft epicenter, logging a 50 percent jump in incidents. Its neighbor, San Bernardino County, wasn’t far behind, with a 47 percent increase that signals a broader, deeply troubling trend across Southern California.

These aren’t just numbers on a page – they represent real economic disruption, lost goods, and mounting challenges for businesses trying to keep their shipments safe. Each percentage point tells a story of vulnerability in our supply chains and the increasingly sophisticated methods of those looking to exploit them.

Warehouses were particularly vulnerable, accounting for one in three incidents. But thieves didn’t limit themselves – parking lots and secured yards were also prime targets.

What’s particularly concerning is how sophisticated these criminal operations have become. They’re not just breaking locks anymore – they’re running elaborate scams, targeting smaller carriers, hijacking accounts, and even posing as legitimate operators to snag shipments from unsuspecting brokers.

The situation isn’t much better north of the border. Ontario has also been subject to a significant spike, becoming Canada’s hotspot for cargo theft.

Industry insiders have pointed to an interesting post-COVID shift: consumers are more willing to buy from unfamiliar online sellers, especially when products come in original packaging. Criminal organizations are exploiting this trend masterfully, often targeting trucks left running at rest stops to maintain cargo temperature. It’s a sobering reminder of how vulnerable our supply chains can be, and a clear call for stronger security measures across the industry.

Does a Freight Recession Increase Cargo Theft Risks?

The impact of a freight recession on cargo theft can be complex and somewhat counterintuitive. Typically, one might expect that a decrease in freight volumes during a recession would lead to a decrease in cargo theft opportunities. However, the dynamics can play out differently based on several factors:

- Increased Vulnerability: During a freight recession, companies often look to cut costs, which might include reducing spending on security measures. This cost-cutting can make cargo more vulnerable to theft as there may be fewer resources like security personnel or technological monitoring systems in place.

- Economic Desperation: A recession can lead to increased criminal activity as economic hardship may drive more people to engage in illegal acts, including cargo theft. This is especially true in areas heavily impacted by job losses and financial instability.

- Change in Cargo Types: The types of goods being transported can change during a recession. For instance, there might be a shift towards more essential goods, which are typically targeted more by thieves due to their ongoing demand and value. This shift can result in new opportunities for cargo theft, even if overall freight volumes are down.

- Supply Chain Disruptions: Recessions often cause disruptions in supply chains, leading to irregularities and inefficiencies. Cargo might spend more time in transit or be stored for longer periods at vulnerable locations like ports or warehouses, increasing the opportunities for theft.

- Insurance and Reporting Issues: During economic downturns, companies might be more reluctant to report thefts for fear of increased insurance premiums or damaging their reputation in a competitive market, complicating efforts to accurately gauge the problem and respond effectively.

Ultimately, while a freight recession might initially suggest a reduction in theft due to lower volumes of goods being moved, the actual impact can result in an increase in theft activities due to heightened vulnerabilities and shifts in both economic conditions and criminal behavior.

Proactive Security as Part of the Solution

In the current high-stakes logistics landscape, transportation companies need to get smart about security – and fast. While security solutions can’t prevent overarching global economic factors like freight industry downturns- they can play a role in preventing and deterring cargo thefts, which can have an even greater impact in a tighter and more competitive market.

It’s no longer enough to rely on a single line of defense. Instead, businesses must build a comprehensive security fortress that combines cutting-edge technology, sharp human vigilance, and strategic deterrents.

Think of it like a complex security puzzle. Physical barriers, smart tech monitoring, rigorous background checks, and ongoing staff training are all critical pieces. The goal? To stay one step ahead of increasingly crafty criminals who are constantly evolving their theft strategies.

Effective security systems should include security innovations including AI-enabled cameras with live video monitoring. These aren’t your average security cameras. We’re talking high-resolution, strategically placed eyes that capture potential weak spots. And they’re not just passive observers. When an unauthorized person is detected, alarms can be immediately sounded, instantly signaling that they’ve been spotted. It’s like having a digital security guard that never blinks working alongside highly trained security professionals who are aware of a business’ unique security needs and protocols monitoring every feed- and there to respond in real time.

But these systems aren’t just about prevention. If a theft does occur, the video footage becomes a critical weapon for law enforcement. High-definition cameras with facial recognition can capture crystal-clear images, and the ability to remotely store this footage means evidence is preserved if something happens.

Many of these systems are now connected to real-time monitoring centers, creating a dynamic, responsive security network. Security personnel can track freight and people movements, spot suspicious activity, and potentially intercept thieves before they can even make their move.

It’s a high-tech cat-and-mouse game, and transportation companies are increasingly determined to win. By layering physical, technological, and human security measures, they’re building increasingly impenetrable defenses against cargo theft- and protecting their business’s bottom line during leaner and more challenging times.

Interested in learning more? Reach out now for a consultation and quote or to learn more about how live video monitoring and surveillance can help protect your business.

Frequently Asked Questions (FAQs):

Does a freight recession increase cargo theft risks?

Yes, a freight recession can increase cargo theft risks due to reduced security spending, increased economic desperation, changes in cargo types, supply chain disruptions, and underreporting due to fear of increased insurance premiums.

How did industries respond to the freight recession?

Industries responded by reducing operational costs, adopting new technologies, and reassessing strategic approaches to mitigate the impacts of the recession.

What technologies are being adopted to combat cargo theft?

Companies are increasingly using AI and blockchain for tracking and managing shipments more securely. Additionally, AI-enabled cameras with live video monitoring are being used to enhance physical security.

What are the most affected areas by cargo theft?

In the U.S., California and Texas saw significant increases in cargo theft, with specific counties like Dallas and Los Angeles being heavily impacted. Ontario was highlighted as a hotspot for cargo theft in Canada.

How can companies improve their security to prevent cargo theft?

Companies should integrate multiple layers of security, including physical barriers, smart technology, rigorous background checks, and ongoing staff training. Implementing comprehensive security systems that include live monitoring can help in effectively deterring thefts.