As you probably know, identity theft is a big problem in the automotive industry. According to FTC’s Consumer Sentinel Network Data Book 2018, there have been almost 19,000 reports of auto loan and lease identity theft in 2018. This is an almost 90-percent increase from the year before. In addition, dealerships can be the target of criminals looking for the data needed to perpetrate other crimes and fraud.

Why Dealerships Are Ripe for Identity Theft and Fraud

Auto dealerships need to be concerned about fraud and identity theft because they house a wealth of customer information, which contains everything a criminal needs to steal someone’s identity. From driver’s licenses, credit card numbers, social security numbers, to financial statements and loan applications, leasing contracts, purchase agreements, and credit reports. All this information puts dealerships at risk for being the source of fraud and identity theft.

This isn’t just a problem for vehicle owners and leasers. It’s a big enough issue that dealership security needs to be a priority. Lawbreakers look for ways to hack into systems for information or trick employees into doing it for them. Scammers may attempt to purchase a vehicle with a fake identity.

Additionally, in some cases, the dealership’s employees can be the source of fraud. A WardsAuto story

reveals that 51 percent of auto dealerships have been the victim of employee theft and embezzlement or know someone who has.

Here are a few reports that show how it becomes an expensive problem. The Statesman has a story of a Bastrop dealership’s accountant who has been indicted for stealing at least $200k. At a dealership in Albany, a vice president and general manager took more than $700k for personal use as Albany Business Review reports. The Darien Times has a story of a woman who embezzled more than $1 million from an auto dealership in New York.

Employee theft and fraud are rarely talked about open in the dealership industry but is constantly reviewed by savvy operators. In many cases in fact, a background check won’t help you. The article states that only 4 percent of the employees had a prior conviction for fraud. This doesn’t mean you should skip the background check. You still want to do that.

KPMG’s Global Automotive Executive Survey 2020 reinforces the need for security, both physical and cybersecurity.

“Whether buying a vehicle or using a mobility service over the next 5 years, nearly half (46%) of all executives absolutely agree that companies that do not focus on data and cyber security are at extremely high risk of sacrificing their brand reputation and failing to deliver real value in their data usage,” writes the authors. “This is also emphasized by this year’s survey results. 53% of consumers make data and cyber security an absolute prerequisite for their purchase decision.”

How Dealership Clutter Affects Security

Historically, dealerships handle a lot of paperwork and in most cases, until recently, most of it is not electronic. They print papers for customers to sign, following state rules in many places. It’s all too easy for papers to stockpile. Paperwork is not always stored securely or thrown away properly.

Dealerships are open to the public. It’s easy for people to wander the building and, if not properly secured, enter restricted document areas.. They can grab papers off desks and out of trash cans which could also become a compliance issue. Dealerships often must follow privacy laws and legislation in the handling and protection of confidential information, especially financial information.

Here are six ways to declutter and improve your dealership security.

1. Create and maintain processes

Having processes in place ensures cluttering never happens. They reinforce your dealership takes personal information and identity theft very seriously. You want to find a happy medium in confirming the customer is who they say they are without overdoing it in asking for personal information.

Employees cannot follow these steps if they don’t know what to do. For example, if you don’t have a process for a clean desk policy, how can you expect employees to follow it?

2. Train employees

Once these processes are created, train employees. Employees need to know how to correctly manage the paperwork and ensure it remains secure. They need to know where to conduct business that involves sensitive data sharing.

Work with a security expert to create training that covers how to watch for forged information and documents, suspicious activities, suspicious behavior, and other red flags or warning signs of potential fraud and identity theft.

They need to sign off on the training to indicate they understood the processes and agree to follow them. The training should never be one and done. They need a refresher at least once a year to avoid becoming complacent.

3. Secure locations where information-sharing occurs

Obviously, you wouldn’t collect customer financing information in the reception area where anyone can overhear the information. That’s why it’s critical to collect such information in a private setting where no one can overhear or see the shared information. There should be no video cameras in these areas. You want to leave nothing to chance.

If possible, only one person should collect the information. Don’t post two employees in the room. If an employee needs to be in the room for a portion of the process, then that employee should not enter until it’s time to do their part, then step out as soon as they’re done.

4. Enforce a clean desk policy

Employees should always have a clean desk. Of course, when they’re doing paperwork with a customer, they’ll have papers on their desk. However, as soon as the customer leaves, the papers need to go where they belong. This could be in a locked cabinet or scanned into the system and shredded.

The key is to do something with them on the spot. Don’t wait until the end of the day. The same goes for all counters including the front desk, showroom, anywhere where papers show up. A nice bonus from the clean desk policy is that it’ll send a message to your customer that you’re organized and care about protecting their information.

5. Shred old documents

You’re not required to keep everything your business has ever done. There is a time when the information does not need to be retained. Scan them into the system and shred the old files. If you still have documents that you can’t shred yet, ensure they’re stored in a safe place. Repeat the process on a regular basis.

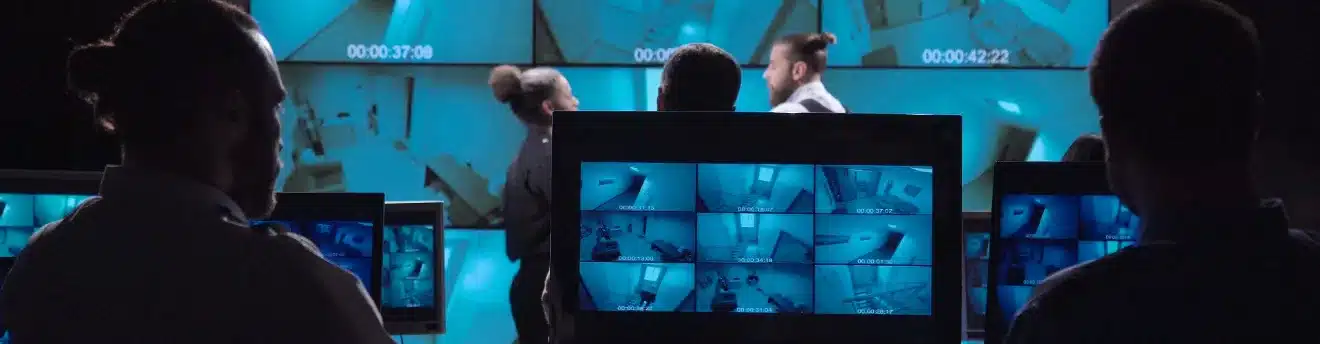

6. Expand dealership security with remote video surveillance

Integrating remote video surveillance in your dealership’s security toolbox provides you with many advantages. The remote part of the technology means having an objective, trained third party watching the entire property on monitors. High-definition cameras and recorders can capture everything for later referencing.

Obviously, you don’t want cameras posted in a room where sensitive information is shared. You can post cameras outside of the room to verify the proper handling of documents.

Benefits of Video Surveillance in Dealership Security

While video surveillance doesn’t solve every issue, it is an important layer to a security platform that can help reduce or eliminate the risk of theft. Using a combination of exterior monitoring and internal systems such as access control or monitored safe and F&I cameras, dealerships can benefit from a layered approach to securing their assets and critical or sensitive customer information.

1. Helps deter theft

Installing cameras around the dealership and having a trained operator monitoring them can and does avert crime. As soon as the operator sees suspicious activity, they act can before anything happens. They may issue an audio warning from a remote location to warn the intruder. Or they may call the police to report the activity while tracking the suspect’s movements.

Here’s an example video of how a speaker deters a trespasser. Here’s another dealership video of how dealership security stopped a car thief. The car did not leave the lot and the business incurred no damages.

As mentioned before, employees could be responsible for fraud and identity theft. They have access to papers and information. Check out this video of a dealership employee stealing car parts. Be transparent and let employees know about video monitoring. This will help decrease the chances of their committing a crime while reassuring their safety.

2. Helps reduce false claims and liability

Dealerships that service vehicles deal with many false claims. Video surveillance can help prove a vehicle already had damage prior to the service team working on it. In this video, a dealership avoids a liability claim by having proof a customer’s car was already damaged when it arrived on the lot. These incidents are hard to prove without video.

3. Helps cut costs

Remote video surveillance costs up to 60 percent less than security guards. You only pay for the technology and for monitoring services. Between the hardware and the monitoring, you may see a ROI within four months.

4. Helps increase operational productivity

Very few dealership security solutions can boost employee and dealership productivity like video surveillance can. Stealth works with management to help clients increase employee productivity. The video footage can record how customers and salespeople move around the lot. In doing so, they identify areas for improvement. As a result, the dealership could enhance its customer service and operations.

Some companies use video in their training. This provides employees with a visual to see how something works. Video cameras can incorporate intelligent video analytics technology to track customer movements. It’ll tell you which cars customers look at and which they buy. Using this information, you’ll improve inventory management and support marketing efforts.

Every industry has unique security requirements including auto dealerships. Stealth can design an effective security solution for yours. Dealerships can fall victim to fraud, identity theft, and other risks. When you work with Stealth, you gain customized security solutions to help protect your assets as well as valuable insights.

Learn more about automotive dealership security by getting your free guide with 9 simple steps to secure your lot. Please feel free to contact us

with your questions.