The shipping and logistics industry has been grappling with the challenges brought about by the COVID-19 pandemic since it first began disrupting supply chains and causing significant fluctuations in shipping volumes more than three years ago. Initially, the pandemic led to a sharp drop in shipping volume in March and early April of 2020 due to lockdowns and restrictions. However, the subsequent surge in e-commerce volume as people increasingly relied on online shopping from home resulted in a continuous increase in shipping volumes that has remained ongoing. Major parcel shippers reporting daily volumes that surpass peak holiday levels for several months became the norm.

With this dramatic increase in volume, capacity concerns became apparent throughout the shipping industry. Carriers requested high-volume shippers scale back their shipments, implementing daily capacity limits and suspending service guarantees. Some carriers introduced significant surcharges in response to the pandemic, and additional costs proved devastating for some smaller businesses already struggling with expenses related to COVID-19.

The surge in business-to-consumer (B2C) volume resulting from the shift to online retail placed considerable stress on shipping networks. As a result, delivery delays, customer complaints, and overall slowdowns have become more common. Implementing capacity limits has been one of the simplest solutions for carriers to address this issue.

Shippers Get Creative with NVOCCs and Freight Consolidation

To cope with these capacity limits, shippers made use of several options. One approach: divert overflow volume to alternative carriers. While it can lead to increased costs, it is a viable solution as the overflow volume is not expected to be permanent. Freight consolidation, involving the use of Non-vessel Operating Common Carriers (NVOCCs) specializing in less-than-container load shipment handling, has also become a popular option. Shippers are also exploring alternatives to major carriers, such as utilizing USPS and DHL services. Since the beginning of the pandemic, NVOs have experienced a significant increase in market share as shippers turn to them to avoid high spot-rates when carriers reach volume caps.

Another strategy for shippers is to consider non-traditional pickup times. Some carriers have available capacity on weekends, which can help alleviate overflow. For example, shippers can accumulate overflow orders throughout the traditional workweek and schedule pickup on the weekend, allowing them to catch up on the backlog by Monday.

Due to the surge in volume and COVID-19-related expenses, costs have risen across the industry. Some shippers are attempting to renegotiate pricing and volume caps to relieve the pressure caused by overflow. Businesses primarily dealing with business-to-business (B2B) freight have an advantage in this regard, as carriers prioritize more profitable business. B2B volumes traditionally have significantly higher profit margins compared to B2C volumes, sometimes three times higher. To offset the costs associated with necessary safety precautions implemented to prevent COVID-19 infections and cover overtime for drivers, carriers have raised rates.

Dealing with Shipping Hub and Port Congestion

In addition to the overflow of e-commerce shipments, the global impacts of the pandemic resulted in congestion at shipping hubs and ports, especially for large-volume international freight. Shutdowns, limited workforce availability, and reduced customs agents contributed to slowdowns in processing shipments and limited available storage.

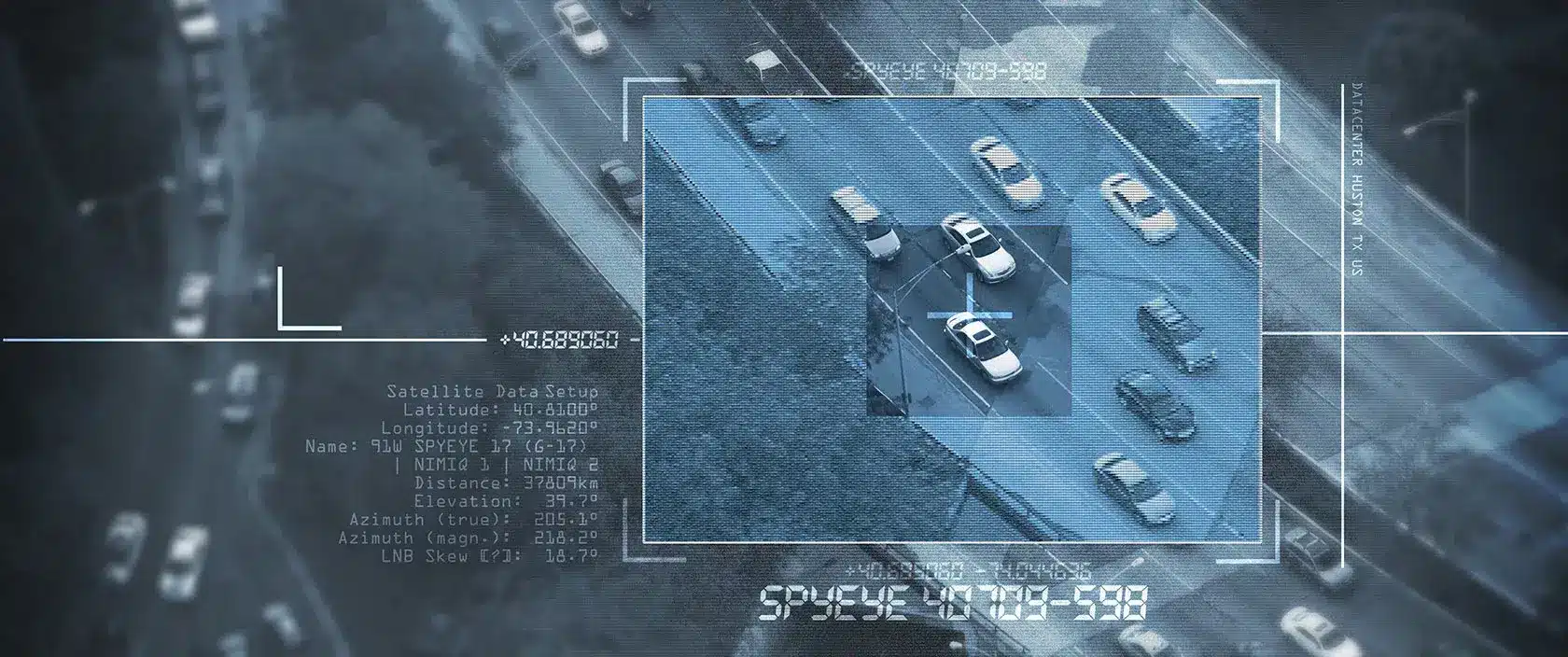

These factors raised security concerns in locations that handle overflow cargo when warehouses reach capacity. Theft of goods is a prominent concern, posing a significant security risk. To mitigate the risk of theft, it’s crucial for shippers and carriers to implement robust security measures at these overflow locations. This can include enhanced surveillance systems, increased physical security, and strict access controls. Regular inventory checks and audits should also be conducted to detect any missing items quickly.

Additionally, there is a can be buildup of potentially hazardous cargo in these congested areas when warehouses reach capacity. Certain types of freight, such as chemicals, flammable materials, or perishable goods, can pose significant risks to the environment, employees, or even public safety if not properly handled. Overflow, however, can mean additional risks- as these situations can create scenarios where improper handling occurs.

Shipping Overflow Security Plays an Important Role

To prevent security issues related to overflow freight, proactive planning and capacity management are essential. Shippers should anticipate the potential for overflow and work closely with carriers to develop contingency plans. Identifying additional storage options, partnering with third-party logistics providers, or implementing dynamic routing strategies to distribute the overflow across multiple facilities can be proactive solutions to addressing capacity limitations. All these solutions may help mitigate the risks of security breaches.

A proactive security solution with live video monitoring can help to reduce and deter cargo, parts, and vehicle theft at storage facilities, warehouses, and cargo overflow storage locations while also providing enhanced site management tools and capabilities. Stealth Monitoring specializes in protecting outdoor assets, inventories, and fleets for leading transportation and logistics companies and their affiliated warehouses, drop lots, and more across North America while saving clients up to 60% off the costs of traditional security guards. With overflow cargo sites can come the additional expense of even more security guards and hours. Live video monitoring allows for a more comprehensive view of a property without the associated risks of insider theft, sleeping guards, or premise liability risks.

For details on Stealth’s transportation and logistics security solutions, contact us today.

Texas Private Security License Number: B14187

California Alarm Operator License Number: ACO7876

Florida Alarm System Contractor I License Number: EF20001598

Tennessee Alarm Contracting Company License Number: 2294

Virginia Private Security Services Business License Number: 11-19499

Alabama Electronic Security License # 002116

Canada TSBC License: LEL0200704